Depending on the duration of the stay, the field of activity in Germany or the registered office of the employer, there are separate regulations for employees with special forms of work, as well as rights and obligations in the field of labour law, social security obligations, family benefits and pensions.

Posted workers are ones who, when a company temporarily performs its services in another country and brings its own employees with it, are temporarily posted to the other country.

If you have an employment contract with an employer based in your country of origin and you have been temporarily posted to Germany on their behalf, you are entitled to all wage regulations applicable in Germany. Therefore the following applies to you:

Please note: For postings that last longer than a month, the employer must issue a document that summarises the essential conditions of the posting (posting contract). Make sure that you receive a posting contract from your employer.

If you have been posted to Germany and have difficulties with your employer who is abroad, you can contact an Advice centre in Germany that specialises in posting. The following short film of the project “Fair posting” (DGB) clearly summarises which rights you are entitled to during a posting to Germany and how you can specifically defend yourself against exploitation:

In addition, on its homepage the project offers additional information on the topics “Posting in general” as well as “Posting in the construction industry” for download. In addition to German, the information is also available in Bulgarian, Romanian, English, Hungarian, Croatian, Polish and Slovenian.

Please note: If you want to take legal action for the above-mentioned German minimum requirements, you can do this at the German labour courts. You can find out which court is responsible for you here. On the other hand, you must assert claims from your employment contract before a court in your country of origin.

If your posting lasts for a maximum of 12 months, you are usually still socially insured in the posting country. The social security in the posting country is certified by the Document A1, which you can obtain from your social security agency. After 12 months, all statutory obligations to pay social security contributions in Germany apply.

A special feature applies to health insurance: in the event of illness, you can also be treated in the country to which you were posted (host country). To do so, you should contact your health insurer in the posting country before you leave. Depending on whether you are only staying temporarily in Germany or are moving your usual place of residence to Germany, you must either apply for a European health insurance card or an S1 form.

You need the European health insurance card if you will only be staying in Germany temporarily. You will receive the medical treatment during your stay in Germany that is necessary during your stay.

You need the Form S1 if you move your usual place of residence to Germany. This means that your stay in Germany is permanent. For example, if you are moving to Germany with your family for a long time. You should present the S1 form to one of the statutory health insurance companies in Germany. This gives you and your family complete health care in Germany.

Please note: It is not necessary to take out travel health insurance for working abroad.

You also continue to pay the tax on wages in the country of origin. However, if you work in Germany for more than 183 days, you are only liable for tax in Germany.

Cross-border workers are workers who do not work in the EU country in which they live, but rather who return to their place of residence daily or at least once a week.

In principle, cross-border workers are subject to the social security law of the country in which they work. Special features apply to you as a cross-border worker:

Tip: If you work as a cross-border worker in Germany, you are entitled to child benefit and other German family benefits.

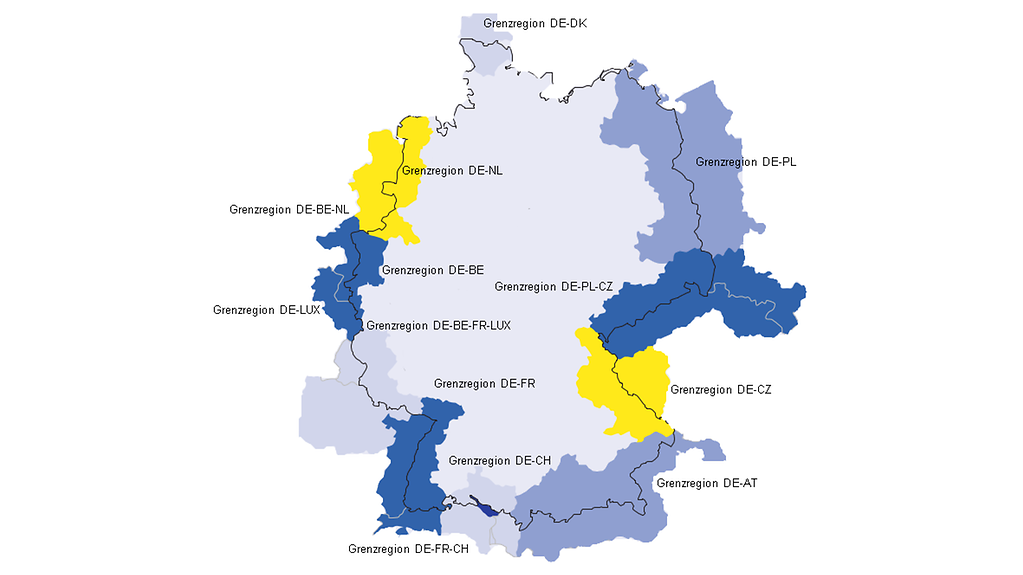

Special information and advisory services for cross-border workers in the various border regions can be found here:

Photo:

You can also contact the Virtual Welcome Centre:

Virtual Welcome Centre

Villemombler Strasse 76

53123 Bonn

Tel: 0049 228 713-1313

Fax: 0049 228 713-1111

Email: make-it-in-germany@arbeitsagentur.de

Seasonal workers are employed in companies that need a large number of workers at short notice at certain times of the year. For this period you will receive temporary employment contracts.

Temporary employees may not be treated worse than comparable permanent employees. In addition, they are to be treated in the same way as German employees. This applies to working conditions, for example wages, dismissal, working hours, holiday leave and public holidays, health protection as well as safety at work. In addition, seasonal workers are also entitled to the statutory minimum wage or possibly relevant sector minimum wages too. You are also entitled to child benefit in Germany if you are subject to unlimited income tax while working in Germany.

Please note: In some cases, certain costs are deducted from the wages. If you are not sure whether certain expenses for food and accommodation are rightly deducted, find out about the maximum amounts on the website of the Customs.

If you work as an Au-pair in Germany, as a rule you are an employee within the meaning of the Freedom of movement for workers. You are entitled to free movement and benefit from employee rights. An activity as an Au-pair can also take place within the framework of a supervisory relationship of a special kind. In this case, you as a non-employed EU citizen with your own means of subsistence are entitled to free movement. The supervisory relationship of a special kind is characterised by certain features and is primarily intended to serve learning the language and the development of knowledge about German culture.

Requirements and tasks:

Tip: Rules for mutual obligations with regard to working hours, free time and pocket money should be established in writing. There is a model contract for this in accordance with the requirements of the European Agreement on Au-pair employment.

Rights:

Tip: In emergencies (e.g. in cases of labour exploitation) you should immediately contact your recruitment agency or the emergency hotline at 0800-111-0-111 or 0800-111-0-222.

You can find more information about working as an Au-pair on the website of the Federal Employment Agency. Among other things, a leaflet “Au-pair with German families” is available here in German and English.

If you want to become self-employed in Germany, you can find extensive information on starting your own business on the Business start-up portal of the Federal Ministry for Economics and Energy. The portal provides in particular an overview of the founding procedure, the required registrations and a lot of information, checklists and learning programs on the topics of starting a business and self-employment.

The main features of self-employment in Germany are:

Please note: If your employment relationship is classified as self-employment in a German company and is designated as such, but you are actually an employee, this is known as “bogus self-employment“.

If a dependent employment relationship actually exists, the regulations for employees apply to you. Your employment relationship will continue to apply and you will be treated like an employee. If the authorities or the court find that you work in a dependent way and are not self-employed, this has legal consequences.

If you are self-employed, but do not have sufficient income for yourself or for your family living with you in the same household, you can receive benefits according to the Social Security Statute Book II.

Marginal employment can exist in two case constellations:

Mini-jobbers do not have to make any contributions to health, long-term care and unemployment insurance. In the pension insurance there is also Mini-jobber compulsory insurance , but you can apply for an exemption from this (see FAQ). If you do not do this, you have to pay 3.9% of your wages to the pension insurance. The employer has to pay flat-rate contributions for health insurance and pension insurance for the Mini-jobbers. This also applies if the Mini-jobber has applied for exemption from the compulsory pension insurance.

In the case of mini-jobs in private households, however, employers only pay just under half of the flat-rate contributions that are otherwise usual for mini-jobs.

Short-term employments are free of insurance in all branches of social insurance. The employer does not have to pay any flat-rate contributions either.

You will not see any deduction for taxes on your pay slip. The taxes are as a rule levied flat-rate with a symbolically low tax rate of two percent. The employer usually pays this two percent.

Further information can be found at Minijob-Zentrale.